Picture this – You go to Costco and see the massive quantities of items but instead of everything being less expensive per unit you pay 20% more.

Costco wouldn’t last long on that business model!

The crazy thing is that is exactly what is happening to many businesses as they go shop for group health insurance plans!

Small group health insurance is often more expensive for the same quality plans that an individual could get on their own even though you are purchasing more plans.

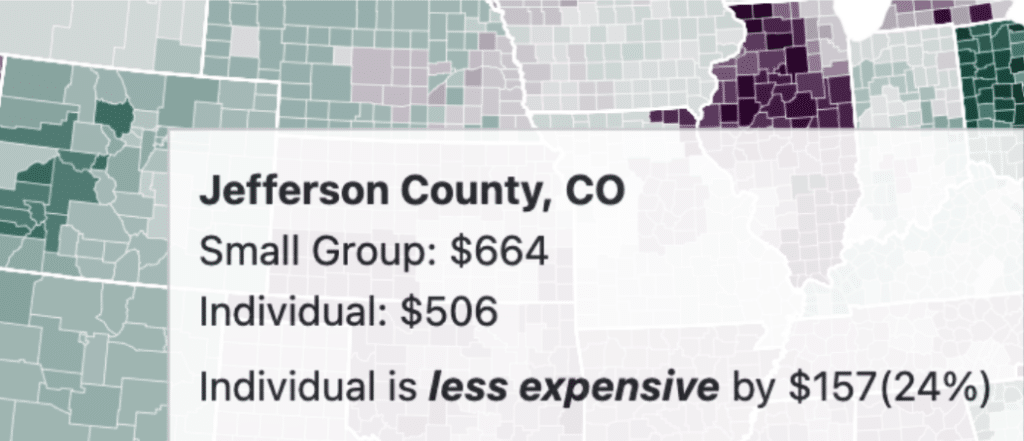

If you live near me in Jefferson County, Colorado, an individual plan is 24% less expensive than if you purchase the same plan using a small group plan.

There’s got to be a better way! Well, let me introduce you to your new best friend in the world of employee benefits: the ICHRA! (That’s pronounced ICK-rah)

ICHRA 101:

In the simplest terms, ICHRA stands for Individual Coverage Health Reimbursement Arrangement, and it has only been available since 2020.

Here’s how it works: Instead of offering a one-size-fits-all group health plan to your employees, you can reimburse them for the cost of health insurance that they choose themselves! 🎉

Yup, you set an amount of money each month and employees use that cash to buy their own individual health insurance plans. No more wrestling with provider networks, skyrocketing premiums, or endless plan comparisons. ICHRA gives you the control to budget your health benefits, while employees get to pick a plan that suits their unique needs. Everybody wins!

Why Should You Care About ICHRA?

Let’s look at some reasons why ICHRA might be the superhero your benefits package has been waiting for:

1. Cost Control for You

Health insurance premiums continue to go up. The average small group plan has gone up 35 percent in the last 5 years! ICHRA lets you decide exactly how much you want to contribute to each employee’s health coverage. No more scary renewal increases or trying to make a one-size-fits-all plan fit your diverse team.

You set the budget, no forced annual increase.

2. Freedom for Your Employees

Ever had an employee complain that your company’s health plan doesn’t cover their favorite doctor or the specific medication they need? With ICHRA, employees get to choose the individual plan that works best for them from the marketplace. They can pick the coverage, network, and benefits they like. Freedom!

3. Bye-Bye, Administration Nightmares

Let’s face it—managing a traditional health insurance plan is a pain and the requirements seem to change every year! With ICHRA, you handle the budgeting part, and employees handle the choosing part. No more picking a group plan, updating employees’ health records, or constantly fielding questions about benefits.

Employees want the control and ICHRA gives it to them.

But Wait, There’s More!

We know what you’re thinking: “This sounds pretty cool, but what’s the catch?” Well, like anything awesome, there are a few things you should know before diving in.

1. Employees Need to Shop for Their Own Plans

Yes, your team will need to go out and buy their own health insurance on the marketplace. For some employees, this could feel like being a kid in a candy store; for others, it might feel more like homework. But don’t worry, Pursuit has your people covered. Our partner technology and staff will walk each employee through the plans that are right for them.

2. Compliance, Compliance, Compliance

ICHRAs are still subject to ACA (Affordable Care Act) rules, so you’ll need to make sure your plan meets certain guidelines, like affordability requirements. Once again Pursuit has you covered, we ensure the plans meet affordability requirements and all communication and compliance is handled by our team.

3. Not a Fit for Everyone?

While ICHRA can work wonders for many businesses, some industries or employees may not get as much bang for their buck.

It is one of the many reasons that Pursuit is committed to not offering just one type of plan. We will help you evaluate the small group plans, ICHRA and PEO options.

How to Get Started with ICHRA

Let’s schedule a time to connect and we will look forward to learning more about the goals you have for your employees and insurance this year.

The Bottom Line

ICHRA is a total game-changer for small businesses. It’s flexible, cost-effective, and takes a lot of the headaches out of offering health benefits. Whether you’ve been struggling with high premiums, trying to offer a benefits package that pleases everyone, or just want more control over your budget, ICHRA could be the solution you’ve been dreaming of.

So, what are you waiting for? Time to get your business hooked up with ICHRA and start making employee benefits great again!